As per section 2(8) of the Companies Act, 2013, the Authorised capital or nominal capital means such Capital as is authorised by the Memorandum of Association of a Company to be the maximum amount of share capital of the Company.

Hence, a Company can issue shares up to the limit of the amount of Authorised capital of the Company, as shown on the MCA21- Company Master Data.

Therefore, in case, the Company wants to expand its business or wants to issue shares more than its Authorised Capital, the Company is required to increase the Authorised share Capital of the Company according to Section 61(1) of the Companies Act, 2013 by following the prescribed procedure, as mentioned below with the help of illustrations.

Contents

PROCEDURE TO INCREASE THE AUTHORISED SHARE CAPITAL OF THE COMPANY:

Step 1: Article of Association (AOA) to be check, whether, AOA of the Company authorised for the alteration of MOA; if no, firstly alter the AOA by passing Special Resolution in the General Meeting of the members of the Company.

Step 2: File e-form MGT-14 with ROC, for the alteration of Article of Association (AOA),

Documents required for Alteration of Article of Association;

- Passing of Board Resolution in the Board Meeting;

- Passing of Notice of EGM, for alteration of AOA;

- Passing of Special Resolution for alteration of AOA;

- Altered AOA;

- File MGT-14, with ROC; within 30 days from the date of passing of Special Resolution.

Step 3: Increase the Authorised share Capital of the Company by altering Memorandum of Association (MOA) in the general meeting of the members of the Company.

Step 4: File SH-7, with ROC, for increase in Authorised share capital of the Company.

Documents required for Increase in Authorised Share Capital of the Company;

- Passing of Board Resolution in the Board Meeting;

- Passing of Notice of EGM, for alteration of AOA;

- Passing of Special Resolution for alteration of AOA;

- Altered MOA;

- File e-form SH-7, with ROC; within 30 days of passing Special Resolution

Step 5: Stamping duty and ROC Fees for Increase in the Authorised share Capital of the Company;

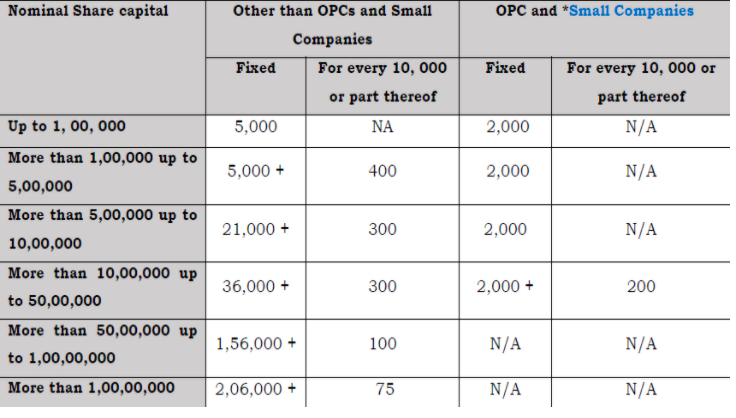

Whenever, Company wants to increase its Authorised share capital, it has to pay the Stamp duty fees and ROC on the increased amount. The calculation of fees as per the given table;

MOA Registration Fees Structure:

MOA Registration Fees Structure – Cs Riya Khurana

Please Note:

As per the Instruction Kit of e-form-SH-7, the fees shall be payable by calculating the difference between the amount of fees to be payable on the increased Authorised share capital and the amount of fees already paid on the existing authorised share capital of the Company.

The Fees shall be calculated as follows:

The Fees payable on INR 10, 00,000 (already paid, as per the prevailing rates at the time of filing) = INR 36,000/-

The fees payable on INR 60, 00,000= INR 1, 66,000/-

Total amount to be paid to ROC= 1, 66,000 – 36,000 =INR 1, 30,000/-

Stamp Duty Fees on MOA

The stamp duty shall vary from state to state.

As per stamp duty rule for e-form SH-7, for the state of Delhi (Companies having share capital other than Section-8 Company), the stamp duty to be payable shall be 0.15% of authorised share capital of the Company subject to maximum Rs.25 Lakh of Stamp Duty.